THE SEEED OF INNOVATION

In the world of business, a single idea can transform an industry. But without proper financial management and accounting, even the most innovative concept can falter. That's where the right team of accounting professionals comes in - they can help turn that seed of innovation into a thriving business. With their expertise, businesses can ensure that their financial systems are in order, taxes are paid on time, and budgets are managed effectively. By providing accurate financial information, accountants can help entrepreneurs make informed decisions that drive growth and success. So whether you're launching a startup or growing an established business, remember that the right accounting team can make all the difference.

Accounting Services

Accounting is basically a process where we keep track of financial transactions and also prepare financial statements, which are balance sheets and income statements. Accounting is basically a key function in the business functioning process.

In a small business, accounting and bookkeeping are done by a professional accountant or a bookkeeper but in large companies accounts and finance is handled by a finance department where a group of employees is hired to manage company finance.

- Proper managed Business Records

- Helps to make a better decision

- Business Valuation

- Prevents your Business from Financial Frauds

- Easy Tax & Liabilities Calculation

- Control Extra Cost

THE SEEED OF INNOVATION

01.Start-Up

Streamline your finances and stay investor-ready with smart bookkeeping from day one!

- Dedicated Bookkeeper

- Bi-weekly Bookkeeping

- Highly Experienced Accountant

02.Growing

Scale your bookkeeping business with efficiency, accuracy, and client trust!

- Dedicated Bookkeeper

- Tri-weekly Bookkeeping

- Monthly Financials Statements

03.Established

Maintain excellence and expand your reach with trusted, expert bookkeeping!

- Full-Time Bookkeeper

- Expert Financial Accountant

- Bank & Credit Card Reconciliation

Accounting records generate three key financial statements

In accounting, income statements help you to gather information regarding the Profit and Loss of your Company.

The balance sheet prepared while accounting helps you to get clarification of the financial status of your business on a particular date.

The cash flow statement in accounting acts as a connector between income statements and balance sheets.

It is very complicated to keep the financial records up to date and if you want to keep your business finances accurate, it becomes very necessary to keep the records up to date.

Types of Accounting & Finance Services

01.Managerial Accounting:

This type of accounting is a practice for using financial information from product revenue including outputs and inputs that affect the supply chain. Basically, this form of accounting supports the organization with wider efficiency and also tracks the progress of the organization in order to achieve fixed goals.

02.Tax Accounting:

This type of accounting includes the preparation and return of taxes that are required to be payable. Tax accounting can be used by businesses, professional entities, corporations, and any individual. This form of accounting basically focuses on income, deductions, donations, and many more.

03.Cost Accounting:

This type of accounting involves a process of accumulating and determining the productivity cost. This process includes commitment and control of cost. This form of accounting covers cost interpretation, data analysis, and cost classification.

04.Financial Accounting:

This form of accounting has a process that involves recording, summarising, and reporting revenue expenses in a period of time. Financial accounting includes the preparation of all kinds of financial statements that are involved in the business.

05.Payroll Accounting:

This form of accounting has a tracking system of business expenses that are related to the payroll. It also includes compensation for every individual employee as well as payroll taxes, employee beneficial payments, federal beneficial withholdings, and several other deductions.

06.Bookkeeping:

Bookkeeping is a process that involves the recording of company financial transactions and daily accounting. This form of accounting includes various data recording techniques and is also an important part of your company’s accounting process.

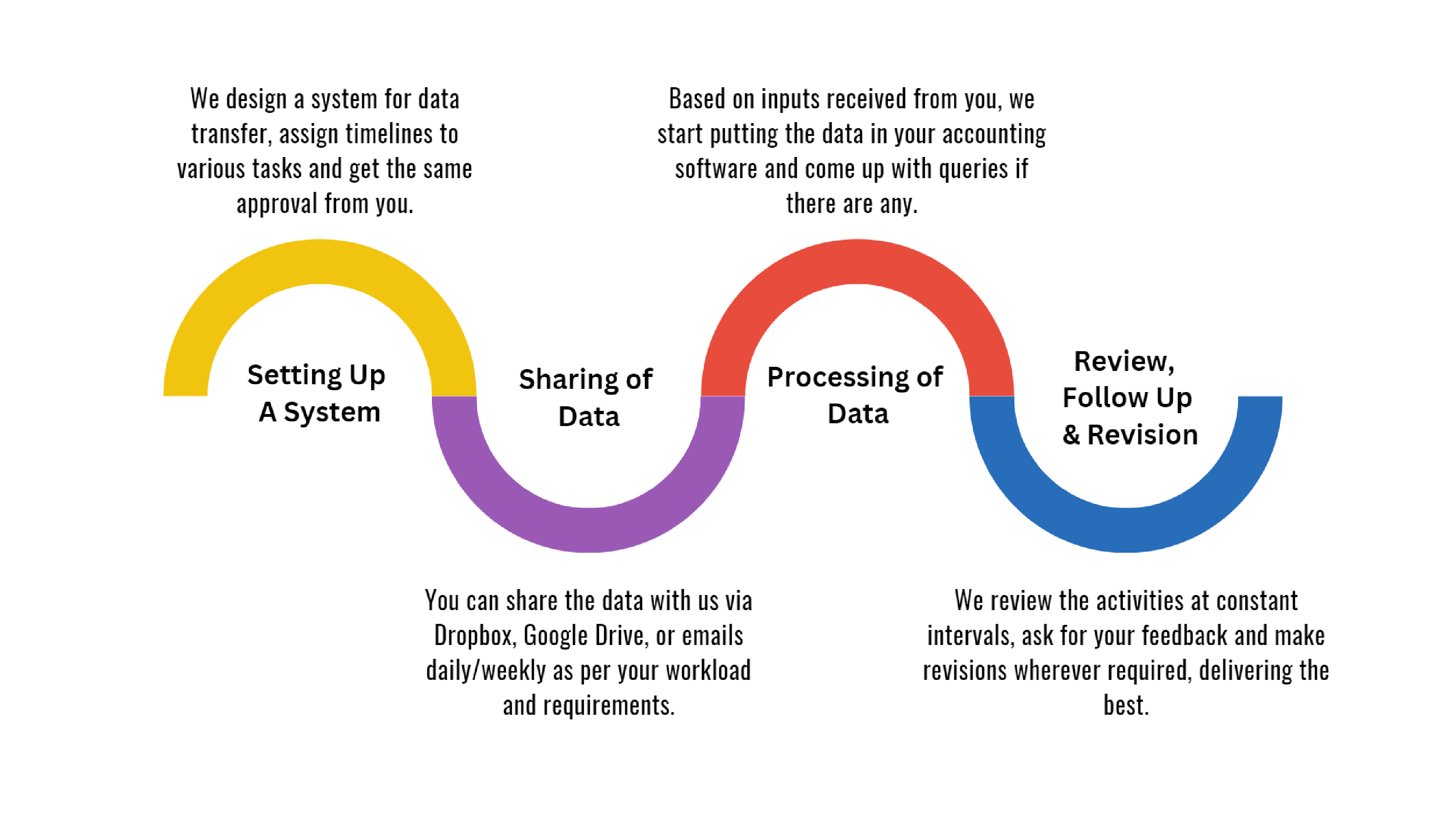

Our Accounting Outsourcing Services Process

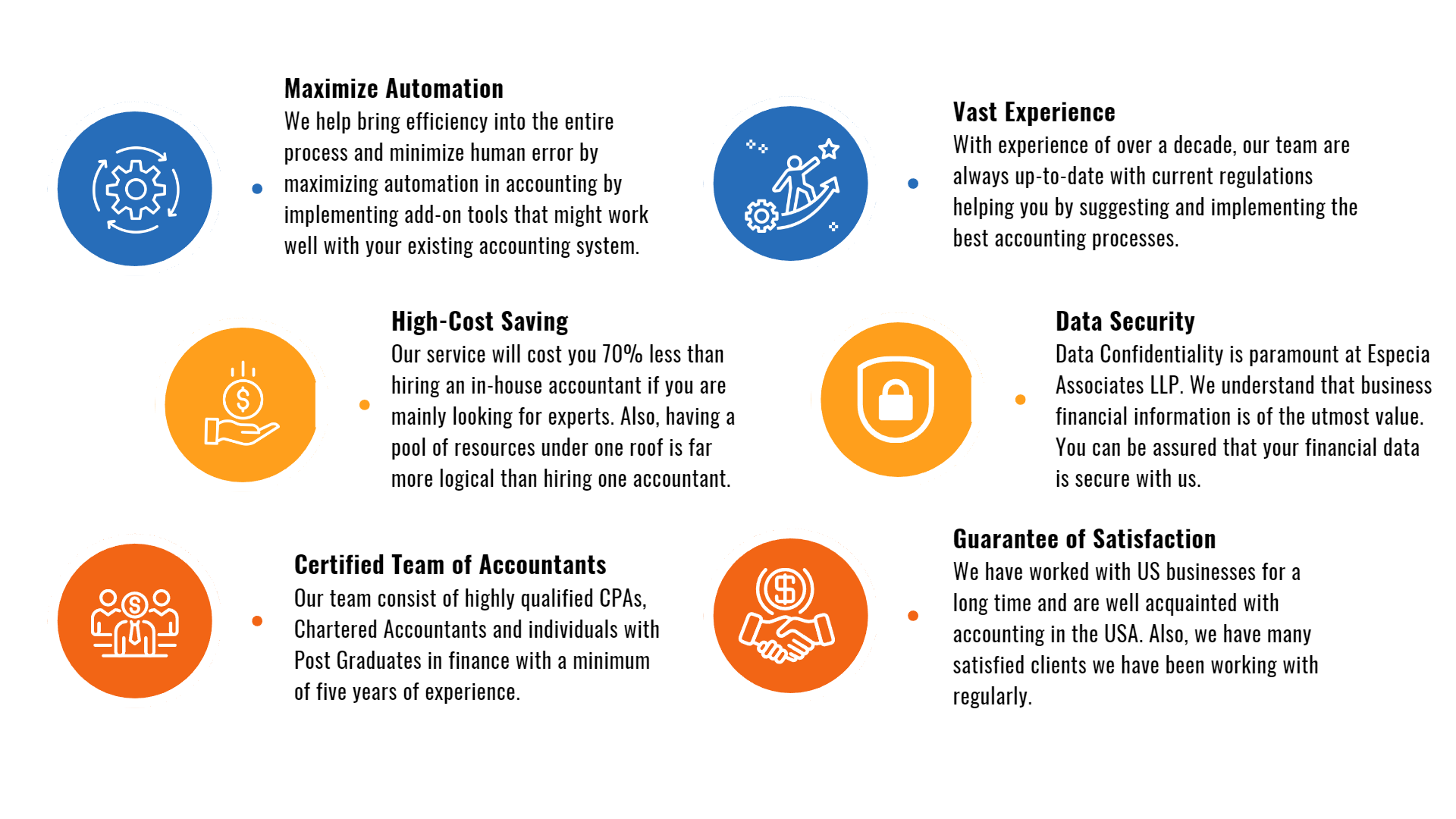

Why Choose Especia Associates ?